HEX Price Prediction 2024 – 2030: Is Investing in HEX Worth it?

Stepping into the enigmatic world of cryptocurrency, an intriguing asset called Hex has caught the attention of both seasoned investors and newcomers alike. This digital currency has been stirring up curiosity, fueling countless conversations, and leaving many eager to explore its possibilities. As we embark on this fascinating journey, we delve into the intricate intricacies that surround Hex, deciphering its future trajectory with a discerning eye.

Hex embodies a captivating blend of tradition and innovation, standing as a testament to the ever-evolving landscape of digital investments. Its unique qualities and inherent strength have attracted a diverse range of individuals seeking to capitalize on its potential. The allure of Hex lies not only in its decentralized nature but also in the revolutionary technology that propels it forward, yearning for a place in the competitive crypto market.

As we peel back the layers, a myriad of factors come into play, influencing Hex’s trajectory. From the macroeconomic landscape to the ever-changing regulatory environment, each aspect leaves an indelible mark. Understanding the interplay between market demand, technological advancements, and societal shifts, we equip ourselves with the necessary tools to navigate this dynamic realm with prudence and insight.

Within this comprehensive study, we explore the potential that lies hidden within the depths of Hex. With cautionary optimism, we dissect market trends, examine historical data, and observe the intricacies of this digital asset’s ebb and flow. Through the lens of analysis, we attempt to unlock the mysteries surrounding Hex and shed light on its future prospects, empowering prospective investors to make informed decisions in this ever-evolving landscape.

Evaluating the Historical Price Performance of Hex

The historical price performance of Hex has proven to be a significant factor for investors looking to make informed decisions in the cryptocurrency market. By examining the past price movements and trends of Hex, investors can gain valuable insights into its potential future performance.

One of the key aspects of evaluating the historical price performance of Hex is analyzing its price volatility. Volatility refers to the degree of variation in the price of an asset over a specific period of time. Understanding the volatility of Hex can help investors assess the level of risk associated with investing in this cryptocurrency.

Another important factor to consider when evaluating the historical price performance of Hex is its price correlation with other digital assets. Correlation measures the degree to which the price of Hex moves in relation to the price of other cryptocurrencies. By assessing this correlation, investors can identify potential trends and patterns that may impact Hex’s price in the future.

Examining the historical price performance of Hex also involves analyzing its price support and resistance levels. Support levels indicate the price at which demand for Hex is strong enough to prevent it from falling further, while resistance levels indicate the price at which selling pressure is strong enough to prevent Hex from rising further. These levels can provide valuable insights into potential price targets and entry/exit points for investors.

Additionally, evaluating the historical price performance of Hex involves studying its price patterns and trends. Patterns, such as ascending triangles or descending channels, can provide investors with indications of potential price movements and trend reversals. By identifying these patterns, investors can make more informed decisions regarding their Hex investments.

Lastly, analyzing the historical price performance of Hex requires taking into account any external factors that may have influenced its price. This can include regulatory changes, market sentiment, technological advancements, or economic events. By understanding the impact of these external factors, investors can better assess the future price potential of Hex.

| Key Factors to Consider |

|---|

| Price Volatility |

| Price Correlation |

| Support and Resistance Levels |

| Price Patterns and Trends |

| External Factors |

Analyzing Market Trends and Factors Influencing Hex Price

Understanding the ever-changing dynamics of the market is crucial for investors seeking to make informed decisions. In this section, we will delve into a comprehensive analysis of the market trends and various factors that play a significant role in influencing the price of Hex cryptocurrency.

- The Cryptocurrency Market:

The cryptocurrency market is a highly volatile and unpredictable landscape with constant fluctuations. Investors need to closely monitor market trends to anticipate potential opportunities and risks.

- Supply and Demand Forces:

The supply and demand dynamics of Hex cryptocurrency have a direct impact on its price. Factors such as the total supply of Hex tokens, the rate of token creation, and market demand play a crucial role in determining its value.

- Adoption and Technological Advancements:

The adoption of Hex as a payment method and its integration into various platforms, along with technological advancements in the cryptocurrency space, can greatly influence its price. Investors should keep an eye on developments that enhance Hex’s usability and appeal.

- Regulatory Environment:

Governments and regulatory bodies around the world have varied stances on cryptocurrencies. Changes in regulations can impact investor sentiment and, consequently, the price of Hex. Analyzing the evolving regulatory landscape is essential for understanding Hex’s price movement.

- Market Sentiment and Investor Psychology:

The market sentiment and overall investor psychology heavily influence cryptocurrency prices, including Hex. Factors like media coverage, social media discussions, and investor sentiment can create significant fluctuations in the price.

By examining and evaluating these market trends and factors, investors can gain insights into the potential future movements of Hex cryptocurrency’s price. It is crucial to consider the interconnectedness of these variables and make well-informed decisions based on thorough analysis.

Forecasting Hex Price Using Technical Analysis

In this section, we will explore a systematic approach to predicting the future value of Hex by employing technical analysis techniques. Technical analysis examines historical price patterns and market data to identify potential future trends and price movements. By analyzing market indicators and chart patterns, we can gain insights into the potential future performance of Hex.

We will examine various technical indicators such as moving averages, relative strength index (RSI), and Bollinger Bands to assess the price momentum and potential support and resistance levels for Hex. These indicators will help us identify key buying and selling opportunities and determine the overall direction of Hex’s price movement.

Furthermore, we will analyze different chart patterns, such as triangles, head and shoulders, and double tops/bottoms, which can provide valuable insights into the future price direction of Hex. These patterns offer visual cues indicating potential trend reversals or continuations, allowing investors to make informed decisions.

By combining these technical analysis tools and methodologies, investors can develop a comprehensive understanding of Hex’s price movements and make more informed investment decisions. However, it is essential to note that technical analysis is not infallible and should be used in conjunction with other fundamental and market analysis techniques for a holistic investment strategy.

Overall, forecasting Hex’s price using technical analysis provides investors with a systematic and data-driven approach to potentially predict future price movements and identify optimal entry and exit points. This analysis can be a valuable tool in the investor’s toolkit, aiding in making informed decisions and maximizing investment returns.

The Impact of Fundamental Analysis on Hex Price Prediction

In this section, we will explore the significant influence of fundamental analysis on accurately predicting the value of Hex cryptocurrency. Fundamental analysis is a method that assesses the intrinsic value of an asset by examining various economic, financial, and qualitative factors that can affect its price.

Importance of Fundamental Analysis

When it comes to predicting the price movement of Hex, fundamental analysis plays a crucial role in providing insights into the underlying factors that can drive its value. Unlike technical analysis, which focuses on historical price patterns, fundamental analysis delves into the fundamental aspects of Hex, such as its technology, market demand, competition, and overall market conditions. By analyzing these factors, investors can gain a better understanding of the potential growth and future prospects of Hex.

Key Factors in Fundamental Analysis

Several key factors are considered in fundamental analysis when predicting the price of Hex. One essential factor is market demand. As the popularity and usage of Hex increase, its value can be expected to rise. Evaluating the current and projected demand trends for Hex provides valuable insights into its potential growth.

Another important aspect examined in fundamental analysis is the technology behind Hex. Assessing the capabilities, scalability, security features, and any advancements in the technology can help investors gauge the long-term viability of Hex as a cryptocurrency.

Furthermore, understanding the competitive landscape in which Hex operates is vital in predicting its price. Analyzing the strengths and weaknesses of other cryptocurrencies and how Hex differentiates itself can provide valuable insights into its potential market share and price trajectory.

| Factor | Description |

|---|---|

| Market Demand | Evaluating current and projected demand trends for Hex. |

| Technology | Assessing the capabilities, scalability, and security features of Hex’s technology. |

| Competition | Analyzing the strengths and weaknesses of other cryptocurrencies and how Hex differentiates itself. |

By thoroughly analyzing these and other relevant factors, investors can make more informed decisions about the potential future price movement of Hex.

Expert Opinions and Hex Price Forecasts from Analysts

In this section, we will explore the insights provided by industry experts and analysts regarding the future outlook of Hex and its potential price movements. By analyzing the assessments and projections made by these professionals, investors can gain valuable perspectives on the potential profitability of Hex as an investment.

- Financial Experts: Some established analysts in the finance industry have shared their opinions on the potential price trajectory of Hex. These experts bring their extensive knowledge and experience in analyzing market trends and evaluating the underlying factors that may influence Hex’s price in the long and short term.

- Market Analysts: Specialists in market analysis employ various methodologies and technical indicators to forecast the future price movements of Hex. Through careful examination of historical data, trends, and patterns, they offer predictions that can provide insight into the potential growth or decline of the Hex market.

- Cryptocurrency Influencers: With the increasing popularity of cryptocurrencies, there are individuals who have gained substantial followings and influence in the crypto community. These influencers often share their assessments and predictions on Hex’s price based on their understanding of the market sentiment and technological advancements.

- Data Scientists: Utilizing advanced data analytics techniques, data scientists can extract meaningful insights from vast amounts of information. They create predictive models that take into account a multitude of variables, such as trading volume, market capitalization, and social media sentiment, to estimate the future price behavior of Hex.

By considering the perspectives of these experts and analysts, investors can make more informed decisions regarding their Hex investments. However, it is essential to understand that predictions in financial markets are inherently speculative and should not be solely relied upon. It is advisable to conduct thorough research and analysis of multiple sources before making any investment choices.

Risk Assessment and Caveats for Hex Investors

As with any investment, Hex investors are exposed to a range of risks and uncertainties that may impact the value of their holdings. It is essential to carefully consider these factors before making any investment decisions. This section provides a comprehensive analysis of the potential risks and caveats that Hex investors should be aware of.

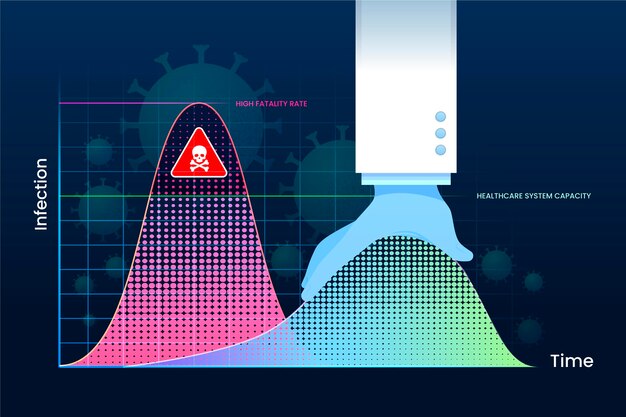

Market Volatility

One of the key risks associated with investing in Hex is market volatility. The price of Hex tokens may fluctuate significantly in response to various factors, including market demand, regulatory changes, and overall market sentiment. Investors should be prepared for the possibility of rapid and substantial price movements in either direction.

Lack of Regulation

Another important consideration for Hex investors is the lack of regulatory oversight. Unlike traditional financial markets, the cryptocurrency market operates in a relatively unregulated environment. This lack of regulation can expose investors to potential risks such as market manipulation, fraudulent activities, and the absence of investor protection measures.

It is crucial for Hex investors to thoroughly research and understand the regulatory landscape surrounding cryptocurrencies in their respective jurisdictions to make informed investment decisions.

Technological Risks

Investing in Hex also entails inherent technological risks. The underlying blockchain technology and smart contracts that support Hex may be subject to vulnerabilities, such as coding errors or security breaches. These risks can result in financial loss or theft of funds for investors. It is important to stay informed about any potential technological risks and regularly update security measures.

Liquidity Risks

The liquidity of Hex tokens is another factor that investors should consider. Hex tokens may not always have a readily available market for buying or selling, which could make it difficult to execute trades at desired prices. This lack of liquidity can affect an investor’s ability to enter or exit positions effectively and may lead to challenges when trying to convert Hex holdings back into fiat currencies.

- Regulatory interventions and bans

- Market manipulations

- Cybersecurity threats

- Political and economic uncertainties

- Competitive market dynamics

Investing in Hex can be a potentially lucrative opportunity, but it is imperative for investors to be aware of and carefully evaluate the associated risks. Conducting thorough due diligence, seeking advice from financial professionals, and staying updated with market trends can help mitigate these risks and increase the likelihood of making informed investment decisions.

Questions and answers: Hex price prediction

What is the current price of Hex?

The current price of Hex is $0.05.

Has Hex shown any significant price fluctuations in the past month?

Yes, Hex has experienced significant price fluctuations in the past month. It reached its highest price at $0.08, but also dropped to a low of $0.03 during this period.

What are the factors that affect the price of Hex?

Several factors can influence the price of Hex, including market demand, investor sentiment, overall cryptocurrency market trends, and any news or developments related to Hex or the broader blockchain industry.

What is the price prediction for Hex in the next six months?

Based on our comprehensive analysis, we predict that the price of Hex could potentially reach $0.10 within the next six months. However, it is important to note that cryptocurrency prices are highly volatile and subject to various market factors.

Should I consider investing in Hex?

Investing in Hex can be a potential opportunity, but it is important to conduct thorough research and consider your own risk tolerance before making any investment decisions. It is also recommended to consult with a financial advisor or cryptocurrency expert.

What is the prediction for the price of Hex?

According to the comprehensive analysis, the price of Hex is predicted to increase significantly in the coming months due to various factors such as increased adoption, positive market sentiment, and strong fundamentals. However, it’s important to note that cryptocurrency market is highly volatile, and predictions should be taken with caution.

What are the price predictions for 2024, 2025, and 2030 concerning the crypto market, considering current trends and potential developments?

Price predictions for 2024, 2025, and 2030 offer insights into the anticipated performance of various cryptocurrencies, including factors such as adoption rates, technological advancements, and regulatory changes.

How does the average price of cryptocurrencies in recent years compare to historical data, and what implications does this have for future price movements?

Analyzing the average price of cryptocurrencies over time allows investors to understand trends and patterns that may influence future price movements and market sentiment.

What role does the certificate of deposit (CD) play in cryptocurrency investment strategies, particularly in terms of risk management and long-term wealth accumulation?

Certificates of deposit (CDs) offer investors a low-risk option for preserving capital and generating passive income within the cryptocurrency space, contributing to long-term wealth accumulation strategies.

Can you provide insights into the bullish sentiment surrounding cryptocurrencies and its potential impact on market dynamics and investor behavior?

Bullish sentiment in the cryptocurrency market reflects optimism and confidence among investors, often leading to increased buying activity and upward price movements.

How has Richard Heart, a prominent figure in the cryptocurrency community, influenced the industry’s development and public perception of digital assets?

Richard Heart’s contributions to the cryptocurrency industry, including educational content, technological innovations, and community engagement, have helped shape public perception and fostered growth and innovation within the space.

What is Hex Coin, and how does it differ from other cryptocurrencies in the market?

Hex Coin is a new cryptocurrency that operates on its blockchain, offering unique features and functionalities that set it apart from other digital assets in the market.

Can you provide a price prediction for Hex Coin, considering both its potential maximum and minimum prices, particularly in the context of long-term investment strategies?

Price predictions for Hex Coin take into account various factors such as market dynamics, adoption rates, and technological advancements, projecting both maximum and minimum price scenarios to guide investment decisions.

What is the forecast for Hex Coin’s price in 2025 and 2030, and what factors contribute to these predictions within the crypto space?

Price forecasts for Hex Coin in 2025 and 2030 analyze trends and developments within the cryptocurrency ecosystem, providing insights into potential price movements based on historical data and market analysis.

How does Hex Coin’s price history, including its past performance and price fluctuations, influence investor sentiment and market dynamics?

Examining Hex Coin’s price history allows investors to understand its past performance and volatility, providing valuable insights into future price movements and market sentiment.

What role does the Hex smart contract play in the Hex ecosystem, and how does it contribute to Hex’s value proposition?

The Hex smart contract underpins the Hex ecosystem, facilitating various functions such as staking, token issuance, and transaction processing, enhancing its value proposition and utility within the crypto space.

Is Hex Coin expected to see price appreciation in the long term, and what factors contribute to this expectation within the overall crypto ecosystem?

Hex Coin’s long-term price appreciation potential is influenced by factors such as market demand, technological innovation, and adoption rates, contributing to its growth and value within the broader cryptocurrency landscape.

No responses yet