Milady Crypto – Embracing the Rise of Cryptocurrencies in the Modern Digital Age

Unlock the enigmatic world where technology meets finance, a realm filled with immense potential and endless possibilities. Welcome to the electrifying universe of cryptocurrency, a digital landscape that has revolutionized the way we perceive and engage with money. Brace yourself as we embark on a captivating journey that will delve deep into the intricacies of this dynamic domain.

Within this captivating expedition, we navigate the uncharted waters of decentralized currencies, where traditional banking systems are challenged, and digital assets assert themselves as the future of transactions. Prepare to be astounded as we uncover the intricate mechanisms and cryptographic protocols that underpin these virtual currencies, enabling secure and seamless transactions across borders and industries.

As we sharpen our understanding of this fascinating realm, we will encounter a plethora of terminologies, each bearing its distinctive significance. From blockchain technology, which acts as the backbone of the crypto world, to altcoins, tokenization, and decentralized finance, we unravel the intricate vocabulary that has emerged along with this evolving landscape. Prepare to be captivated by the kaleidoscope of possibilities that this revolutionary technology has unlocked.

In this multidimensional odyssey, we not only unravel the complexities of cryptocurrency but also explore the profound impact it has had on the global economy. We witness the disruptive force that has spurred the innovation in various sectors, propelling fintech companies to new heights. Moreover, we delve into the challenges and concerns associated with this digital empire, such as security breaches and regulatory dilemmas, which require careful navigation to ensure a safe and prosperous journey into the world of digital wealth.

The Rise of Cryptocurrency: A Brief History

The emergence and growth of digital currencies has revolutionized the financial landscape in recent years. This section examines the fascinating journey of cryptocurrency, from its humble beginnings to becoming a global phenomenon.

1. Early Concepts (2008 – 2010): At the core of cryptocurrency’s birth lies the concept of a decentralized digital currency, free from the control of any central authority. In October 2008, a mysterious person or group using the pseudonym Satoshi Nakamoto published the groundbreaking white paper “Bitcoin: A Peer-to-Peer Electronic Cash System.” This document introduced the world to Bitcoin, the first cryptocurrency, which aimed to establish a new era of financial sovereignty and autonomy.

2. Bitcoin’s Genesis (2009 – 2013): Bitcoin came into existence in January 2009, with the release of its open-source software. The early years were marked by a small community of enthusiasts mining and trading these digital coins. Satoshi Nakamoto himself mined the first set of Bitcoins, preserving the genesis block, also known as Block 0, as a symbolic representation of the technology’s birth.

3. Altcoins and Diversification (2011 – present): As Bitcoin gained popularity, developers began creating alternative cryptocurrencies, often referred to as “altcoins.” These digital currencies incorporated various modifications and improvements, addressing perceived limitations of Bitcoin. Some notable examples include Litecoin, launched in October 2011, and Ethereum, introduced in July 2015, which pioneered the concept of smart contracts.

4. Mainstream Adoption (2014 – present): With each passing year, cryptocurrencies moved closer to mainstream recognition. Major companies and institutions started accepting Bitcoin as a form of payment, paving the way for wider adoption. Additionally, the establishment of cryptocurrency exchanges made it easier for individuals to buy, sell, and trade various digital assets.

- 4.1 Regulatory Challenges: The rapid rise of cryptocurrencies raised concerns among governments and financial regulators worldwide. The lack of centralized control and potential for misuse necessitated regulatory oversight, resulting in varying approaches to cryptocurrency regulations in different jurisdictions.

- 4.2 Technological Innovations: The growth of cryptocurrency also spurred innovations in blockchain technology, the underlying technological framework powering these digital currencies. From scalability solutions to privacy enhancements, developers continuously strive to improve the efficiency, security, and usability of cryptocurrencies.

5. Future Prospects: As cryptocurrency gains mainstream attention and acceptance, its future prospects appear promising. The potential for financial inclusivity, transparency, and decentralized applications continues to attract interest and investment from individuals, institutions, and governments alike.

In conclusion, the brief history of cryptocurrency showcases its evolution from an obscure concept to a global phenomenon, challenging traditional financial systems along the way. Understanding this history sets the stage for further exploration into the intricate world of cryptocurrencies.

Understanding Cryptocurrency: How Does It Work?

In this section, we will delve into the intricacies of cryptocurrency and explore its fundamental workings. Cryptocurrency is a digital or virtual form of currency that utilizes cryptography for secure transactions. Unlike traditional forms of currency issued by central banks, cryptocurrency operates on a decentralized network known as blockchain.

Decentralization and Blockchain Technology

One of the core concepts of cryptocurrency is decentralization. Unlike traditional banking systems where a central authority governs the transactions, cryptocurrency operates on a peer-to-peer network. This means that no single entity has control over the currency, and transactions are verified by network participants through consensus algorithms.

At the heart of cryptocurrency lies the blockchain technology. The blockchain is a distributed ledger that records all transactions and ensures their immutability. Each transaction is stored in a block, and these blocks are linked together chronologically, forming a secure and transparent chain of transactions. The decentralized nature of the blockchain ensures that no single entity can manipulate the transaction history.

Cryptographic Principles

Cryptocurrency relies heavily on cryptographic principles to secure transactions and control the creation of new units. Cryptography involves the use of mathematical algorithms to encrypt and decrypt data. In the context of cryptocurrency, cryptographic techniques are employed to secure transactions, verify identities, and control the supply of the currency.

- Public and private key encryption: Each user in the cryptocurrency network has a unique public and private key pair. The public key is used to receive funds, while the private key is used to sign transactions and prove ownership.

- Hash functions: Cryptocurrency uses hash functions to turn transaction data into fixed-length strings of characters. This ensures the integrity of the transaction data and prevents tampering.

- Proof of work/Proof of stake: To validate transactions and add them to the blockchain, cryptocurrency networks utilize consensus algorithms such as proof of work or proof of stake. These algorithms require participants to solve complex mathematical problems or hold a certain amount of currency to validate transactions.

By understanding the decentralized nature of cryptocurrency, the use of blockchain technology, and the application of cryptographic principles, we can gain a deeper insight into the workings of this innovative digital currency.

The Benefits of Cryptocurrency: Advantages for Businesses and Individuals

In the ever-evolving landscape of digital currencies, there are numerous advantages that cryptocurrency brings to both businesses and individuals. This groundbreaking form of decentralized currency offers a multitude of benefits, creating unique opportunities for financial growth and security.

One key advantage of cryptocurrency is its ability to facilitate seamless and secure transactions. Unlike traditional banking systems, cryptocurrency transactions are conducted directly between users, eliminating the need for intermediaries such as banks or payment processors. This not only reduces transaction costs but also minimizes the risk of fraud and unauthorized access, providing businesses and individuals with heightened security.

Another significant benefit of cryptocurrency is its potential for global reach. With traditional financial systems, cross-border transactions often involve lengthy processes and high fees. In contrast, cryptocurrency transcends geographical boundaries, enabling businesses and individuals to engage in instant and cost-effective transactions on a global scale. This opens up new possibilities for international trade and collaboration, fostering economic growth and expanding market opportunities.

Cryptocurrency also paves the way for financial inclusivity, particularly for individuals in underbanked or financially underserved communities. By leveraging the power of blockchain technology, cryptocurrencies offer a decentralized financial system that is accessible to anyone with internet access. This empowers individuals who may have limited access to traditional banking services, providing them with greater control over their financial assets and fostering economic empowerment.

Furthermore, the transparency and immutability inherent in blockchain technology offer increased accountability and trust in financial transactions. Cryptocurrency transactions are recorded on a distributed ledger, visible to all participants of the network. This transparency reduces the potential for fraud and manipulation, instilling confidence in financial transactions for businesses and individuals alike.

Lastly, the potential for significant returns on investment is a compelling advantage of cryptocurrency. Though the crypto market can be volatile, it presents opportunities for individuals and businesses to generate substantial profits. Cryptocurrency investments have seen exponential growth over the years, attracting both seasoned investors and newcomers seeking to capitalize on the expanding digital market.

In conclusion, cryptocurrency brings a multitude of advantages to both businesses and individuals. Its ability to facilitate secure transactions, enable global reach, promote financial inclusivity, ensure transparency, and offer potential returns on investment makes it a compelling asset in today’s digital landscape.

Investing in Digital Assets: Advice and Tactics for Achieving Success

In this section, we will explore valuable insights and effective strategies to guide you on your journey of investing in the exciting world of digital currencies. Whether you are a novice or experienced investor, understanding the tips and strategies outlined here will help you make informed decisions that can lead to potential success in the cryptocurrency market.

First and foremost, it is crucial to conduct thorough research and gain a comprehensive understanding of the digital asset you are interested in investing. This entails studying the underlying technology, examining market trends, and evaluating the project’s potential for long-term growth. By doing so, you can make well-informed investment decisions and minimize the risks associated with the highly volatile cryptocurrency market.

One crucial tip to consider is diversifying your cryptocurrency portfolio. Rather than investing solely in one digital asset, spreading your investments across various cryptocurrencies can help mitigate potential risks. Diversification allows you to capitalize on multiple opportunities and protect your portfolio from the adverse effects of a sudden price decline in a particular cryptocurrency.

Additonally, setting a realistic investment goal is essential for long-term success. Cryptocurrency investing is a long-term game, and aiming for quick gains can often lead to impulsive decisions and unnecessary risks. Instead, focus on developing a sustainable investment strategy that aligns with your financial goals and risk tolerance. Patience and discipline are paramount in navigating the cryptocurrency market effectively.

Furthermore, staying updated with the latest news and developments within the cryptocurrency industry is crucial for successful investing. The cryptocurrency market is highly influenced by regulatory changes, technological advancements, and market sentiment. By staying informed, you can anticipate market movements, identify emerging opportunities, and make timely investment decisions.

Last but not least, it is essential to secure your digital assets. With the rise of cyber threats and hacking attempts, safeguarding your cryptocurrency investments is of utmost importance. Utilizing secure wallets, employing two-factor authentication, and practicing good cybersecurity hygiene will help protect your investment and mitigate the risk of losing your digital assets.

By adhering to these tips and implementing effective investment strategies, you can navigate the intricate world of cryptocurrency investing with confidence and increase your chances of achieving success in this ever-evolving market.

The Challenges and Risks of Cryptocurrency: Security and Regulation

In this section, we will delve into the various challenges and risks that arise in the realm of cryptocurrency, specifically concerning security and regulation. We will explore the complex nature of these issues and their potential impact on individuals, businesses, and even the wider economy.

The Challenge of Security

One of the primary concerns surrounding cryptocurrency is its vulnerability to cyberattacks, fraud, and theft. As digital assets, cryptocurrencies rely heavily on secure technologies and protocols to protect users’ funds. However, the constantly evolving landscape of cybersecurity poses immense challenges. Hackers and malicious actors continuously develop new tactics to exploit vulnerabilities and gain unauthorized access to cryptocurrency wallets, exchanges, and other platforms.

Another aspect of security concern lies in the absence of a central governing authority in the cryptocurrency ecosystem. While decentralization is one of the fundamental principles of cryptocurrencies, it also means that there is no central entity responsible for ensuring the security and safety of transactions. This lack of oversight and accountability poses risks and leaves users more susceptible to fraudulent activities.

The Need for Regulation

The inherent risks associated with cryptocurrencies have prompted calls for regulatory measures to protect both investors and the overall stability of the market. These challenges include issues such as money laundering, terrorist financing, and market manipulation. Without adequate regulations in place, these illicit activities could proliferate, undermining the legitimacy and trust placed in cryptocurrencies as a viable form of digital currency.

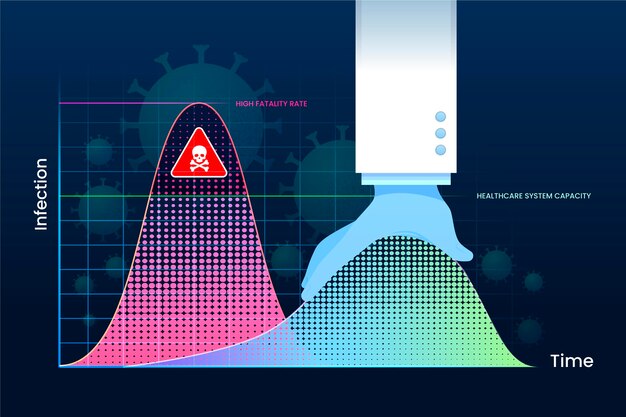

However, finding the right balance between regulation and innovation is a delicate task. Excessive regulations may hinder the growth and development of the cryptocurrency industry, stifling technological advancements and potential economic benefits. Striking a balance that ensures consumer protection, market integrity, and innovation is a necessary step to address the risks associated with cryptocurrencies.

In conclusion, the challenges and risks surrounding the security and regulation of cryptocurrencies are complex and multifaceted. The ongoing battle against cyber threats, the need for accountability in a decentralized ecosystem, and the delicate balance between regulation and innovation are all crucial aspects to consider. Understanding and addressing these challenges is essential for the continued growth and adoption of cryptocurrencies in a secure and regulated environment.

The Future of Cryptocurrency: Trends and Predictions

In this section, we will explore the potential future developments and forecast the trends in the world of digital currencies. As the popularity and adoption of cryptocurrencies continue to grow, it is essential to anticipate the direction in which the industry is heading to make informed decisions and stay ahead of the curve.

One of the key trends that we can expect is the widespread acceptance and integration of cryptocurrencies into mainstream financial systems. With more regulatory frameworks being established and major institutions recognizing the value of digital assets, cryptocurrencies are likely to become an integral part of our daily lives.

Another important trend to watch out for is the increasing focus on privacy and security within the cryptocurrency space. As individuals become more aware of the potential risks and vulnerabilities associated with digital transactions, there will be a growing demand for robust security measures and anonymity features.

Furthermore, we can predict a shift towards the development and implementation of stablecoins. These digital currencies are designed to have a stable value by pegging them to a reserve asset like traditional fiat currencies. Stablecoins offer stability and reduce the volatility commonly associated with other cryptocurrencies, making them more suitable for everyday transactions.

Additionally, the advancements in blockchain technology will continue to shape the future of cryptocurrencies. As scalability and speed issues are addressed, we can expect to see more efficient and scalable blockchain solutions. This will facilitate faster transactions and increase the scalability of digital currencies, making them more practical for widespread adoption.

Moreover, the integration of cryptocurrencies into various industries beyond finance is on the horizon. Sectors such as healthcare, supply chain management, and entertainment are exploring the potential benefits of blockchain and digital currencies. This diversification will open up new opportunities and expand the use cases of cryptocurrencies.

In conclusion, the future of cryptocurrency holds immense potential for growth and innovation. With the acceptance of digital currencies by major institutions, increased focus on privacy and security, adoption of stablecoins, advancements in blockchain technology, and integration into various industries, the cryptocurrency landscape is set to evolve significantly in the coming years. Staying informed about these trends and making informed decisions will be crucial for individuals and businesses alike.

Questions and answers: Milady crypto

What is cryptocurrency?

Cryptocurrency refers to digital or virtual currency that uses cryptography for secure financial transactions, control the creation of additional units, and verify the transfer of assets. It operates independently of a central bank.

How does cryptocurrency work?

Cryptocurrency works on a technology called blockchain, which is a decentralized system where transactions are recorded in a public ledger. It uses cryptography to secure transactions and control the creation of new units. Miners validate transactions and add them to the blockchain.

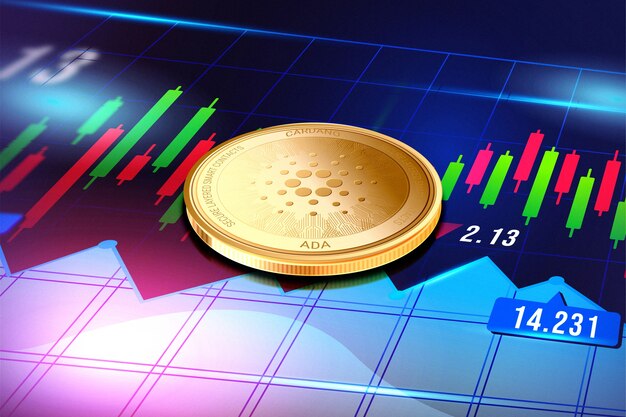

What are some popular cryptocurrencies?

Some popular cryptocurrencies include Bitcoin, Ethereum, Ripple, Litecoin, and Bitcoin Cash. These cryptocurrencies have gained significant adoption and are widely traded.

Is cryptocurrency a good investment?

Investing in cryptocurrency can be seen as a high-risk, high-reward investment. The market is volatile, and prices can fluctuate greatly. It is essential to do thorough research, understand the risks, and only invest what you can afford to lose.

What is Milady Meme Coin, and how does it differentiate itself within the meme coin market?

Milady Meme Coin is a cryptocurrency inspired by the concept of “milady,” targeting a specific niche audience within the meme coin community. It differentiates itself through its branding and community engagement focused on “ladys.”

How has the price of Milady Meme Coin fluctuated over time, and what factors might influence its price chart?

The price of Milady Meme Coin has experienced fluctuations, influenced by various factors such as market sentiment, demand for meme coins, and specific events related to the project’s development and community engagement.

What is the current price of Milady Meme Coin in USD, and how does it compare to previous price points?

The current price of Milady Meme Coin in USD can be found on cryptocurrency exchanges and price tracking websites, reflecting its value relative to the US dollar and providing insight into its recent performance.

How does the market cap of Milady Meme Coin reflect its standing within the broader cryptocurrency market?

The market cap of Milady Meme Coin represents the total value of all circulating coins, providing an indication of its relative size and significance compared to other cryptocurrencies.

What role does the Milady Meme Coin token play within its ecosystem, and how is it utilized by holders and participants?

The Milady Meme Coin token serves as the native digital asset of the project, allowing holders to participate in governance, earn rewards, and engage in transactions within the ecosystem.

How does the trading volume of Milady Meme Coin fluctuate, and what significance does it hold for traders and investors?

The trading volume of Milady Meme Coin reflects the level of activity and liquidity within its market, influencing price movements and providing insights into investor sentiment and interest.

What potential developments or milestones are anticipated for Milady Meme Coin in the year 2023?

Anticipated developments for Milady Meme Coin in 2023 may include ecosystem expansions, community-driven initiatives, protocol upgrades, or strategic partnerships aimed at furthering its adoption and utility.

What is the circulating supply of Milady Meme Coin, and how does it impact its market dynamics and valuation?

The circulating supply of Milady Meme Coin represents the total number of tokens available for trading and circulation, influencing factors such as scarcity, liquidity, and price stability.

How does the total supply of Milady Meme Coin compare to its circulating supply, and what implications does this have for token holders and market participants?

The total supply of Milady Meme Coin encompasses all tokens ever created, including those not yet in circulation. Understanding the relationship between total supply and circulating supply is essential for assessing token economics and potential future dilution.

What insights can be gained from analyzing the trading activity of Milady Meme Coin over the last 24 hours, and how might this information inform trading strategies and investment decisions?

Analyzing the trading activity of Milady Meme Coin over the last 24 hours can provide insights into short-term price trends, trading volume, and market sentiment, helping traders and investors make informed decisions based on current market conditions.

What is the current price of Ladys in USD, and where can I find the live price?

The live price of Ladys in USD can be found on cryptocurrency exchanges and price tracking websites, providing real-time updates on its value relative to the US dollar.

Where can I view the live Milady Meme Coin price, and what factors might influence its fluctuations?

You can view the live Milady Meme Coin price on various cryptocurrency platforms and websites offering real-time price tracking. Fluctuations may be influenced by market demand, trading volume, and broader market trends.

How does the Ladys price today compare to its previous price points, and what insights can be gained from analyzing its price chart?

Analyzing Ladys price charts can provide insights into price changes over time and help identify trends or patterns in its value relative to USD and other cryptocurrencies.

What is the 24-hour trading volume of Milady Meme Coin, and why is it significant for investors and traders?

The 24-hour trading volume of Milady Meme Coin reflects the level of activity within its market, indicating liquidity and investor interest, which can impact price movements and market dynamics.

How does the Ladys token contribute to the Milady Meme Coin ecosystem, and what are its tokenomics?

Ladys tokenomics include details about its supply, distribution, and utility within the Milady Meme Coin ecosystem, providing insights into its role and value proposition.

Where can I track the Milady NFT collection and view its current market price?

The Milady NFT collection can be tracked on NFT marketplaces and platforms specializing in digital collectibles, allowing users to view current prices and market activity.

What is the current market cap of Milady Meme Coin, and how does it impact its position within the cryptocurrency market?

The market cap of Milady Meme Coin represents its total value relative to other cryptocurrencies, reflecting its size and significance within the broader market.

How does the Milady Maker contribute to the Milady Meme Coin ecosystem, and what actions can token holders take with it?

The Milady Maker may play a role in governance, community engagement, or other aspects of the Milady Meme Coin ecosystem, offering holders opportunities to participate and contribute.

Where can I find forecasts and market insights for Ladys, and what should I consider when making investment decisions?

Forecasts and market insights for Ladys may be available on cryptocurrency forums, social media, or investment websites, but it’s important to conduct thorough research and consider various factors before making investment decisions.

How can I stay updated on the latest news and developments within the Milady Meme Coin community, and what resources are available for learning more?

You can stay updated on the latest news and developments by following official social media channels, joining community forums, and accessing resources provided by the Milady Meme Coin team and community.

No responses yet